VAT/UTAP Office

USAG Stuttgart

If you used the Value Added Tax Relief and Utility Tax Avoidance programs during your tour, you probably saved yourself a lot of money. Now that you are PCSing, save yourself a headache and clear these offices the proper way.

VAT Office closeout

VAT Office closeout

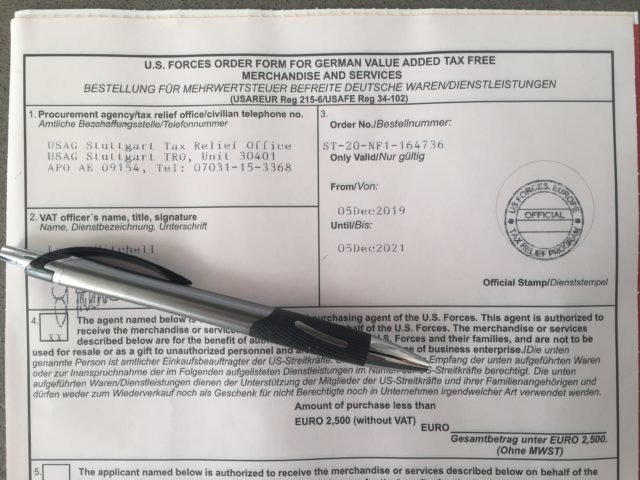

All customers signed up in the Value Added Tax Relief program are required to come in to the Tax Relief Office during their out processing.

To help in the closeout process, once the customer knows they are PCS’ing, they can stop by the Tax Relief Office and a printout of issued VAT forms can be provided.

The Tax Relief staff will review the customer’s account and verify all purchased VAT forms have been returned and cleared from the VAT program.

It is the responsibility of the customer to ensure that all white copies, to include any unused and expired VAT forms, are turned back to the Tax Relief Office before departing.

There must be 100 percent accountability of all VAT forms purchased by the customer. If a customer has any missing/lost white copies, a pink customer copy can also be used to clear the program.

UTAP Office closeout

UTAP Office closeout

All customers signed up in the Utility Tax Avoidance Program are asked to come by the Tax Relief Office before their final walkthrough inspection. No appointment is needed, walk-ins only.

The UTAP staff will assist the customer in identifying which utility company closeout form is required, answer any final questions and direct the customer to the UTAP website to complete the fillable utility closeout form. This form must be typed not hand written.

The UTAP customer will need the final meter reading(s) taken during the final inspection walkthrough to complete the utility company closeout form. The utility closeout form must then be provided to the UTAP Office to close the customer out of the UTAP program. Note: Failure to provide the UTAP Office the required closeout documentation could result in continual monthly payments being withdrawn from the customer’s account.

The UTAP staff will review the closeout form for accuracy and verify the customer’s civilian email address. The final reconciliation invoice from the utility company will be emailed to the customer.

All UTAP customers are required to leave their bank account open for 90 days past their departure date.

Tax office info

The VAT and UTAP offices are located in Room 324, Bldg. 2915, Panzer Kaserne. For more information, call 596-3368 or 09641-596-3368.